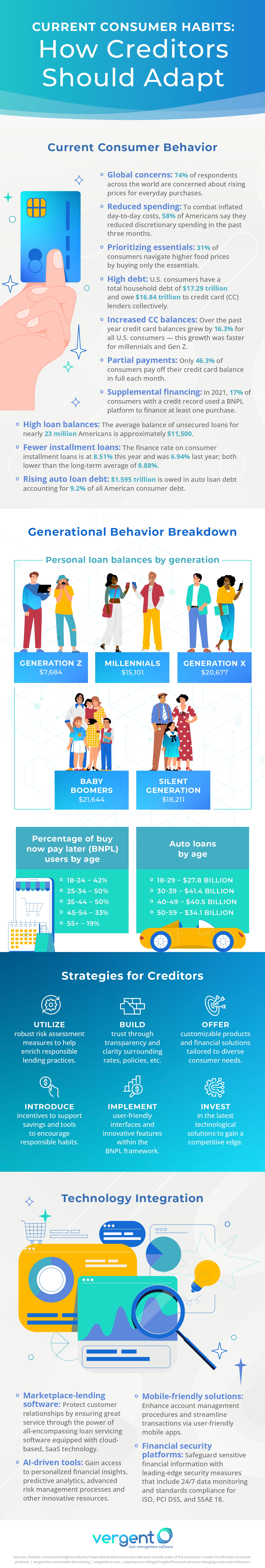

Understanding and monitoring consumer purchasing behavior is crucial for both new entrants and established market participants. These behaviors significantly affect market dynamics, emphasizing the need for businesses to continuously adapt to remain relevant.

The U.S. and global markets are currently facing significant transformations. Economic instability, such as inflation, rising interest rates, and ongoing supply chain issues, is prompting consumers to reconsider their spending habits and increasingly depend on credit.

In this economic landscape, technological innovation is more important than ever. The financial sector must quickly adapt to meet evolving consumer preferences. Financial technology, or fintech, offers the necessary tools for these adjustments, providing innovative solutions to meet new consumer demands.

As the need for advanced financial services increases, so does the importance of robust data security. The financial sector’s expanded use of advanced marketplace lending and loan servicing software for private lenders, especially those utilizing cloud and SaaS platforms, highlights this need. These technologies not only enhance confidence in financial data security but also improve the quality of services provided.

For financial institutions, leveraging these technologies is essential to meet customers’ digital expectations, maintain a competitive edge, and build trust.

For a comprehensive analysis of consumer behavior trends and strategic business adaptation advice, please refer to the additional resources provided below.